Not without a certain level of apprehension, the brand considered influencer marketing and approached DRIM to check out how performance marketing works using influencers as a channel.

Safe to say, we won India’s favourite brand’s trust that influencer marketing with DRIM Global is a reliable and scalable solution to achieve ROI and boost brand awareness.

Tata Neu Personal Loans’ directive for DRIM — Influencers on CPV

Being completely new to a marketing tool for influencer marketing, the brand’s task was straightforward — to get 5 Lakhs meaningful views.

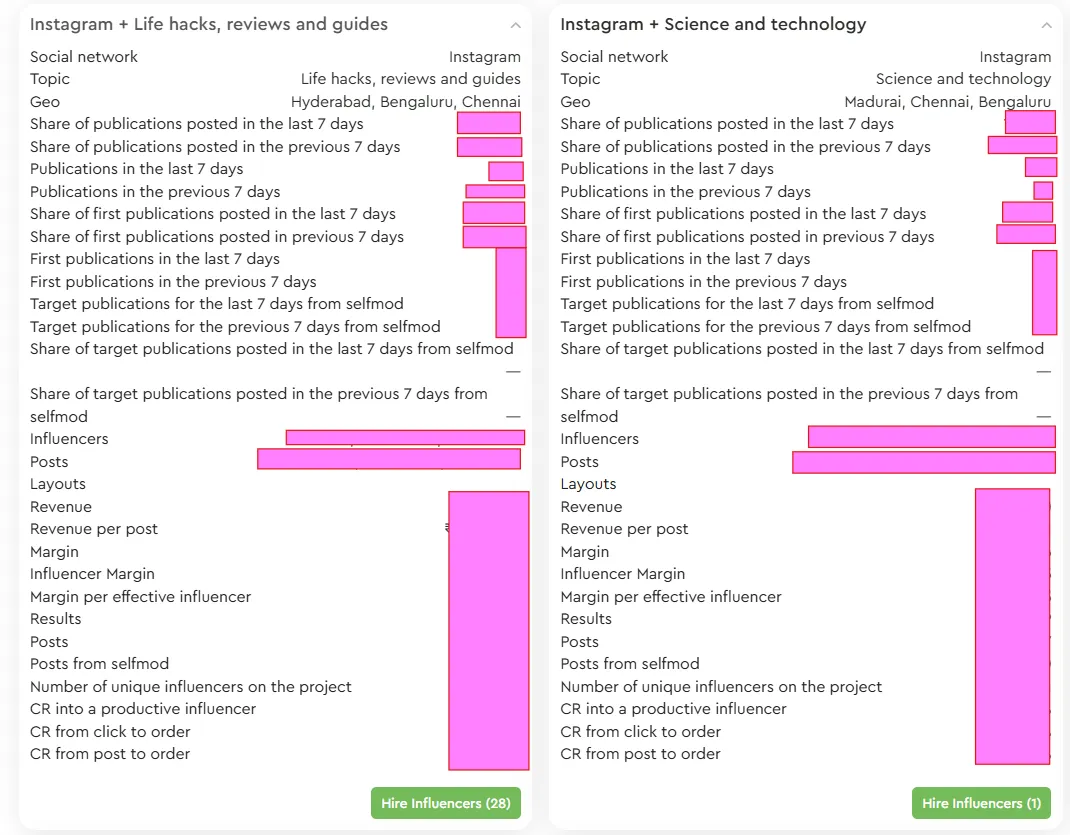

We highlight the benefits of working with DRIM’s unique dashboard that offers transparency and measurability so that brands can understand how their campaign is performing

Check below how the dashboard from DRIM looks like for our marketing campaigns:

Snapshot above: DRIM’s analytical dashboard with data that backs influencer selection. Sensitive data hidden for privacy reasons.

Tata Neu Influencer project execution workflow and pitfalls

The Tata team was clear with their brief and aligned with our vision for influencer selection. This synergy between both parties made it possible to launch and conclude the influencer marketing campaign within a month.

It took only about 10 days to launch the new channel, including:

- The campaign briefing

- Data analysis

- Generating the first cohorts of suitable influencers

- Scouting, onboarding,and shortlisting of the selected micro-influencers

- Narrowing down to three influencers

Our first task was to build the brand’s faith in the process. With complete transparency afforded by the brand’s access to our analytical dashboard, they were clued into each stage of the process, beginning with influencer selection.

Finding the right influencers for the project

According to our discussions with the brand, we focused on influencers from finance segments. Nearly 2.5 Lakhs of micro-influencers on social media are registered in the DRIM database, and using our best-in-class analytics,we narrowed down our search to find top-performing influencers that match the brand’s requirements.

After rigorous scrutiny and analysis of performance metrics, we selected 3 influencers.

The next task was to brief these influencers. Our experience with BFSI products (IDFC, OneCard, BankBazaar, and other similar projects) has given us a better understanding of regulatory bodies' directives regarding advertising financial products.

Read: How to use influencer marketing for BFSI clients

Once the project was announced to our team, our influencer talent managers immediately started approaching the shortlisted influencers and educating them on the details and requirements of the project.

Our team coaches influencers on how to get viral reels with trending content and other guidelines. We do not leave virality to chance at DRIM. We regularly train our teams, who train our influencers on the principles that make content go viral. In this way, influencers in our projects are groomed to deliver maximum results from their first reel/post for a project.

A cooperative and invested brand involvement in the process ensures the best results. Thanks to the cooperation of the Tata team, we went live with the first publication for the project within about 10 days.

Here are the reels published:

Short with 74K+ Likes and 1.1M+ Views

Short with 2.6K+ Likes and 3L+ Views

Challenges and fine-tuning the campaign

As this campaign was the brand’s first experience of trying out influencer marketing, following are a few interesting points to note:

- Establishing streamlined processes:

This was the brand’s first foray into influencer marketing so it took focused efforts to set up a process from scratch and smoothen the edges for content creation and moderation to be executed smoothly.

- Working around posting schedules of influencers:

Another challenge was to get the chosen influencers to work on content and publish them in our tight schedule. We carefully considered our options and closely examined the influencer’s social media profiles and metrics to determine if we could publish. This calculated risk paid off as well! A single influencer with one post on Instagram got over 120 referrals immediately!

- Striking a golden balance between creator’s autonomy and brand directives:

We trust our content creators’ approach as our vast experience has shown us they deliver the best results when their content does not appear too scripted or clinical. This is an approach that has proven to bring results time and again because the target audience is able to identify with the content presented organically in the style they are used to seeing from their favorite content creators.

Creators were allowed the freedom to present content in their own unique way and assuring them that all content created is with a thorough understanding that the brand’s image and values will be upheld.

The brand took a leap of faith with us, and we published the content just the way the influencer presented it. The move paid off, and how! 1 single content garnered over 700K views in the first 7 days from the brand’s target audience!

Take a look at the reel!

Short with 74K+ Likes and 1.1M+ Views

-

Optimising the campaign:

The brand asked for 5 lakh views, and we delivered it! But our team of marketing mavericks is all about the thing that matters the most - conversions.

Our team is a bunch of visionaries who want to turn views into an even more meaningful target action through influencers - a channel that the brand has not tried before.

Read about the awards our pioneering technology has won!

- DRIM Global wins Gold at the Maddies Awards for Influencer backed Performance Marketing Campaign

- DRIM Global wins at IMA 2023: McDonald's West and South triumphs with Influencer Power

- DRIM ’s Big Wins at IDA 2025 with Domino’s and McDonald's

Results and Future Plans:

The collaboration between DRIM and Tata Neu Personal Loans achieved such results:

- 3 influencers on-boarded, filtered from a list of 50

- 5 publications went live

- Over a million views within 7 days

- Over 120 referrals

The marketing efforts hold space for finance influencers or ‘finfluencers’ and other such opinion leaders on social media to leverage their social media presence as new-age personal finance consultants. Influencer marketing taps into the creativity of content creators who have experience in bringing forward information responsibly, respecting not just industry regulations but also brand guidelines.

DRIM has extensive experience with clients from the BFSI sector, which enables us to deliver results consistently by staying on top of ever-changing trends and regulations.

The project team from DRIM behind the Tata Neu Personal Loan influencer campaign’s success

• Head of business strategy: Anshuman Singh

• Head of Scouts: Ksenia Korneva

• Senior Scout: Yuliya Koshelenko

• Senior Key Account Manager: Harshita Gupta

• Head of Affiliates: Anna Morozova

Also read: How to Break Brand Fatigue Using Influencer Marketing

Would you like to know how your brand can benefit from DRIM’s expertise in influencer based performance marketing campaigns? Fill out this form and we will contact you: https://drim.one/contacts

DRIM has extensive experience in influencer marketing and your brand can be next

Check other business cases we have published: